Liquid differs from other platforms because it has no separate equity-like governance token that could lead to conflicting interests. Instead, it uses bitcoin as its native token, which ensures honest participation. This approach helps avoid misaligned incentives between early investors of a token sale and issuers focused on financial applications.

Amounts and asset types are hidden by default, ensuring investors' sensitive financial data stays secure from third parties and front-running. However, issuers can selectively audit their issuances to meet regulatory and transparency requirements when needed.

Liquid is built on Bitcoin's codebase–the most battle-tested in the industry. By employing Bitcoin's UTXO model, Liquid ensures no invalid transactions are confirmed, making it easier for issuers to audit and evict misbehaving peers.

Blockstream's Asset Management Platform (AMP) provides a comprehensive API for issuing and managing digital assets, giving issuers control over their assets' lifecycle, such as whitelisting, flexible equity and debt distributions, and other functionalities.

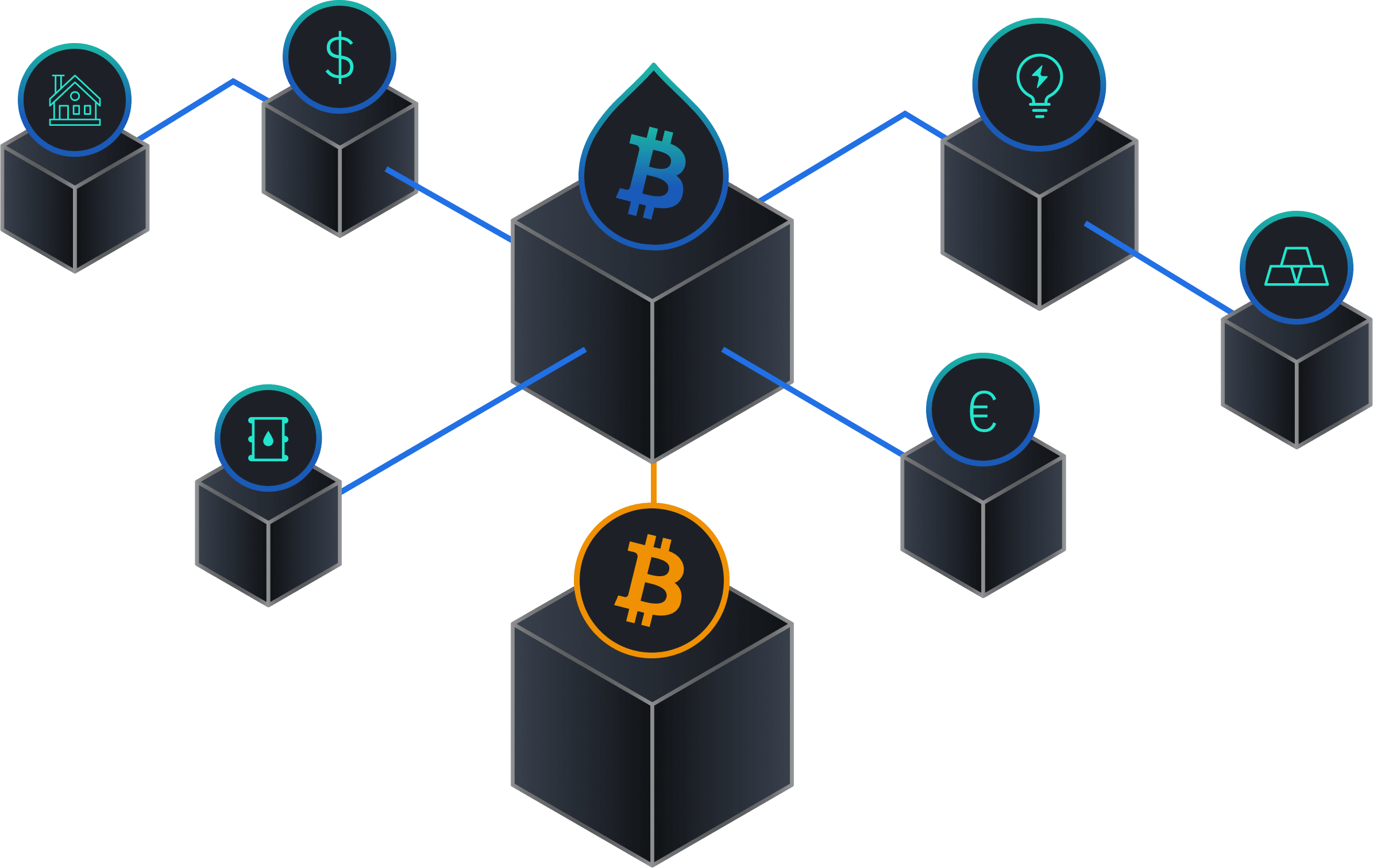

Modern financial products such as securities and commodities can thrive as sound assets on Liquid. Issuers can use AMP, an asset management platform, to securely issue, distribute, and manage these assets, allowing them to participate in the emerging Bitcoin-based capital market.

Optionally, select members of the Liquid Federation offer turnkey AMP-based solutions for enterprises seeking to tokenize institutional-grade assets. These solutions include investment structuring, technical services, end-to-end management of tokenized securities, and more.

A security token issuance and trading platform regulated by the AFSA and registered in the AIFC.

Connects global investors with the world's best assets through a network of digital securities exchanges.

A non-custodial wallet and decentralized trading venue with direct listing and registration services.

The only digital securities issuance platform in Europe that has VASP supervision from an EU member state.

A leading investment exchange committed to empowering clients with access to the global and tokenized economy.

A white-label tokenization platform that digitizes and automates investments, distributions, and trading.